I had an opportunity to test Discovery Bank’s new Discovery AI feature earlier this month. This article will highlight my experience interacting with it. It should be rolled out to all customers already.

So, what is Discovery AI? To put it simply, Discovery says its AI will “securely analyse data related to your accounts and transactions” and will “provide you with personalised insights and recommendations, to make your banking simpler and more rewarding”.

Initially, I thought it was an AI layer baked into the banking app, but realised it is available on Whatsapp, as a secure chat window where you can ask the AI questions. The key differentiator here I believe is the ability to switch to a human agent.

Most chatbots that I’ve experienced can be frustrating when it doesn’t understand you. I typically won’t bother with AI in a customer service environment if I can’t switch to a human because I know my queries will not be straight forward. So knowing it is available is why I would recommend it.

Discovery AI experience

Once I was set-up, I just dove straight into it. It’s not like we were provided a guide book on how to get going, so I asked it questions that came naturally.

When you open the chat window and say “hello”, it will first verify your identity through a push notification on the banking app. I found the result to be instantaneous, there was no lag when you give you approval, so you can continue on the chat window immediately.

I asked it a variety of questions about my bank account, such as how to improve my Vitality Money score, what are my account benefits, travel benefits – tailoring those answers to my current Vitality Money status, the last payment I made on my credit card, all the purchases I made from apps and web services, etc. Initially I asked whatever I could think of.

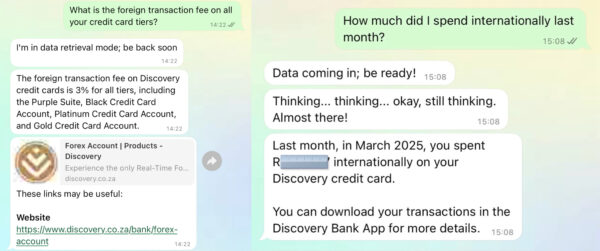

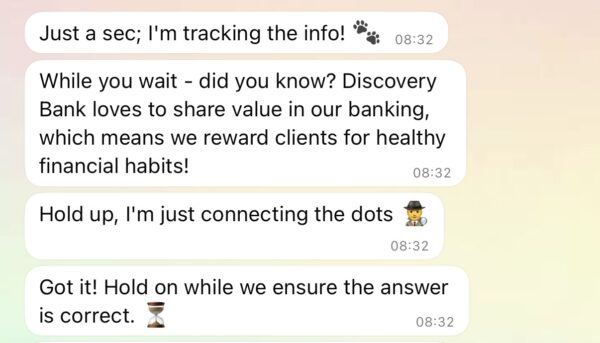

The replies were great. When it is thinking, it tells you stuff like “I’m data digging for you” or “just a sec, I’m tracking the info” or “hold up, I’m connecting the dots”. I love the interaction between the answers so you know what’s going on, as well as the use of emoji with it. It also sometimes shares fun facts about the bank or your behaviour.

I asked it a bit of a difficult question: what were my first 5 transactions on my credit card and it couldn’t reply. Another one was a bit obscure: how often do you need to verify yourself, the frequency, but I believe it is every time you initiate a chat, with a substantial amount of time between the last question where you have to verify yourself again. It also couldn’t tell me when my next RA debit order was going off, and something like: did I spend more or less on clothes than the average client.

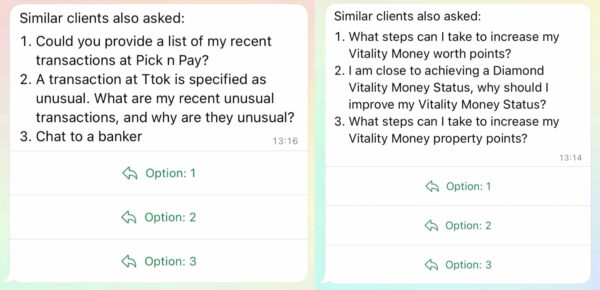

Sometimes, it may also suggest questions that other clients have asked. And then allows you to choose those questions to ask, as an option. But for this, twice now, it didn’t actually have an answer for me, even though I chose their suggestion.

Other useful ones I asked was around forex limits for individuals, what is a tax-free savings account, what the international fee is when swiping your card abroad, which supermarkets are best to shop at to earn Vitality points, and how many points I currently have on Vitality Money, and how to climb the ranks.

For the Vitality Money points reply, it told me for each category what my points were, including my tier status. On how to climb the ranks, it will also provide a link to the Discovery website for more info.

Since I travel a lot, I also asked it how much I spent internationally last month and it gave me a total; and I while I knew some of the answers but for testing purposes, asked anyway: do I need to open my card for international swiping. It also gave me the correct reply, of course.

Some of the questions, as you can gather by now, means you don’t have to go into your banking app. I like how detailed some of the answers can be, like my last 5 transactions for example. It specified my last 5 transactions, with date, amount, merchant, category, etc.

These are just the examples I used that will give you an idea of what the Discovery AI is capable of. I think it’s a useful service if you’re a discovery client and want to know more info about your account, or just general info where you don’t want to call a call centre (my absolute worst).

Discovery AI features list

- Rich analytics and insights: Easily analyse transactions, manage budgets, and see your financial trends over time. Make well-informed financial decisions, whether you’re keeping an eye on changes in grocery spending or finding potential savings in your shopping habits.

- Personalised recommendations: Discovery AI suggests ways to optimise your banking and rewards for immediate needs, identifies personalised savings and investment opportunities, and helps you plan for short-term goals like a holiday or long-term dreams like buying your ideal home.

- Custom alerts and budget reminders: Stay in control of your finances with custom alerts. Set reminders for payments, receive low balance warnings, and be alerted to unusual account activity. Discovery AI ensures you’re always prepared, never miss a payment, and stay informed of crucial account changes.

- Seamless document retrieval: Discovery AI will retrieve bank statements and tax certificates effortlessly. Just ask, and it will be shared in an instant.

- 24/7/365 human support: You can connect with a Discovery Banker anytime through text for continuous, personalised support.

- Natural interaction: Whether you’re sending texts, voice notes, or uploading images and documents, Discovery AI understands and processes natural language queries and visual information seamlessly.

More info via Discovery.

Nafisa Akabor

Related posts

ABOUT

Recharged is an independent site that focuses on technology, electric vehicles, and the digital life by Nafisa Akabor. Drawing from her 18-year tech journalism career, expect news, reviews, how-tos, comparisons, and practical uses of tech that are easy to digest. info@recharged.co.za